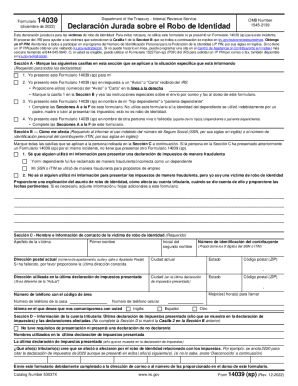

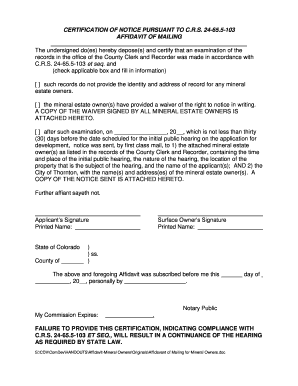

Who Needs Form 14039?

Everyone who has fallen victim to identity theft or who is at risk of having their identity stolen should complete Form 14039, the Identity Theft Affidavit.

What is Form 14039 for?

People use Form 14039 to inform the IRS of stolen sensitive information or about some suspicious activity that may lead to identity theft. The IRS requires this information to identify the suspect and pay the refund, if any, to the right person.

Is Form 14039 Accompanied by other Forms?

Form 14039 should be submitted with at least one document that verifies the filer's identity. These may be a passport, driver’s license, social security card, etc.

When is Form 14039 Due?

The form is due as soon as possible. Once you’ve discovered that your identity is stolen, file the form. Also, complete the affidavit once you’ve got a notice from the IRS about the misuse of your sensitive information. Even if you think your personal data is at risk, fill out Form 14039.

How do I Fill out Form 14039?

Form 14039 is two pages long. It is divided into six sections each marked with a letter:

- Section A shows whether you’re reporting your own situation or filling out the form on someone’s behalf.

- Section B states the reason for completing the form.

- Section C requires identity information of the person filling out the form.

- Section D asks to provide a copy of the suggested documents to verify filer's identity.

- Section E contains the field for a signature.

- Section F is to be completed by the taxpayer’s representative or a relative.

Where do I Send Form 14039?

The form should be submitted to the IRS specialized area either via fax or by mail.